Financial planning

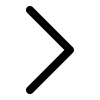

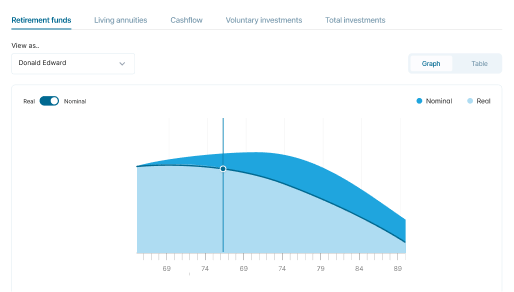

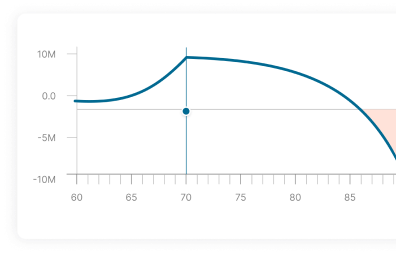

Our all-inclusive financial planning suite is crafted to address your client’s needs and those of their family and related entities. From analysing their investments and long-term risk portfolio to assessing lifestyle assets, liabilities, and budgetary needs, we provide comprehensive solutions designed to empower you in planning for both individuals and businesses.